The Power of Multi-Brand Loyalty Programmes in Driving Engagement and Value

As competition for shoppers’ time, attention and wallet intensifies, retailers fight to differentiate themselves and to win share. Participation in a multi-partner loyalty programme can be a powerful differentiator and can help unlock significant incremental revenue streams.

Tecsa has extensive experience in building multi- partner programmes around the world. These programmes are not new, and coalition loyalty programmes like Nectar in the UK have been running for over 20 years. However, the most successful programmes have evolved considerably, becoming increasingly digital, personalised, and engaging. Whilst transactional earn and burn continue to play an important role, customer experience is an increasingly important factor; focus has shifted to building a more coherent and seamless value proposition across partners, and to developing member communities, often through a single ‘Super-App’.

This article explains why multi-partner loyalty programmes are so effective for retailers, brands, and shoppers. In addition, it discusses how these programmes can help marketers mitigate the loss of third-party cookies and better anticipate demand through richer first-party data. It will also introduce best practices for building a successful multi-brand programme.

The following are some of the key benefits of multi-partner programmes that we have witnessed first-hand.

Advantages for Shoppers

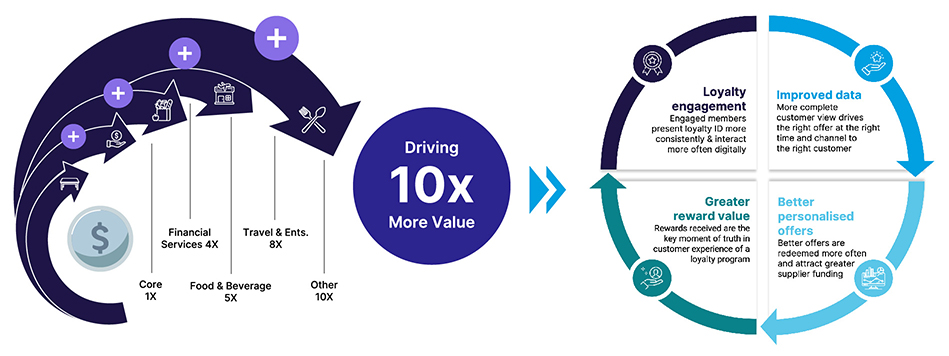

As always in retail, it makes sense to start by considering the benefits to customers. Multi-partner loyalty programmes offer customers greater value and convenience by providing more places to earn and redeem rewards. In Tecsa’s experience, customers can earn up to ten-times more through a multi-partner programme than with a solus programme. This value accumulation drives a virtuous and self-reinforcing cycle (see exhibit 1); as customers realise more tangible value they engage more actively in the programme. Increased interactions across different categories help build a more complete view of customers’ needs and preferences. These in turn lead to more relevant and timely recommendations and offers. As a result, members develop a stronger connection with the programme and are more willing to continue using it.

Exhibit 1: Comparative customer value & self-reinforcing benefit of multi-partner vs solus programme

Advantages for Retailers & Brands

The challenge facing retailers (and arguably all consumer-facing businesses) is to provide consumers with the right product/service, at the right price, and a convenient, personalised, and unified shopping experience, wherever, whenever, and however they choose to engage.

This challenge is made harder by current economic uncertainties. With inflation and interest rates remaining stubbornly high, the squeeze on consumer spending is unlikely to abate anytime soon. Declining discretionary spend coupled with rising costs mean retailers face increasing pressure on both profitability and return on capital.

Multi-partner programmes can help alleviate this pressure by providing higher quality, more accretive customer interactions and incremental revenue streams. Multi-partner programmes also enable partners to share programme operating costs, including tech infrastructure and data science, as well as combine customer insights. The benefits of these programmes extend to all partners provided that there is a consistent and coherent customer value proposition.

Specific programme benefits vary by participant. At the heart of most multi-partner programmes is an anchor business who has significant transaction frequency. This business is typically a grocer or a bank. As the nucleus of the ecosystem, the anchor benefits from a multi-partner programme by being able to monetize its transaction frequency. Through partners, the anchor is able to access adjacent product and service offerings which often have significantly higher profitability and growth potential than their core business. EBITDA margin for many grocers may be low single digit, less than half that of some FS, Travel, Insurance, and Health & Beauty businesses. In addition to access to profitable incremental revenue streams, partnerships can enrich the anchor’s core value proposition and drive member engagement. Saudi Arabian Al Rahji Bank, the world's largest Islamic bank, saw a 210% increase in membership for its Mokafaa loyalty programme in 2022. This growth was driven by an expansion of the programme through onboarding over 100 merchants across various sectors, including supermarkets, restaurants, and pharmacies (https://www.thetecsagroup.com/case-studies/al-rajhi-bank)

For non-anchor partners, being part of a multi-partner ecosystem offers significant advantages in terms of engagement and efficiency compared to launching their own programme.

Firstly, they can leverage the existing reach of the anchor company, which often boasts a substantial customer base, and capture the attention of customers that they wouldn't be able to reach otherwise. For example, in Japan, Rakuten, the e-commerce giant, has a loyalty ecosystem with nearly 40m monthly active users (over 30% of the population), which a smaller retailer can gain access to by partnering with the programme.

Secondly, joining a multi-partner programme offers a cost-effective way of gaining an understanding of customer preferences and behaviour, at a level which is usually out of the price range of most smaller companies. Leading multi-partner programmes are often powered by complex and expensive martech stacks. By joining the programme, partners can take advantage of advanced data science capabilities and access insight derived from the various partner touchpoints across the ecosystem.

How to Create an Outstanding Multi-Partner Programme

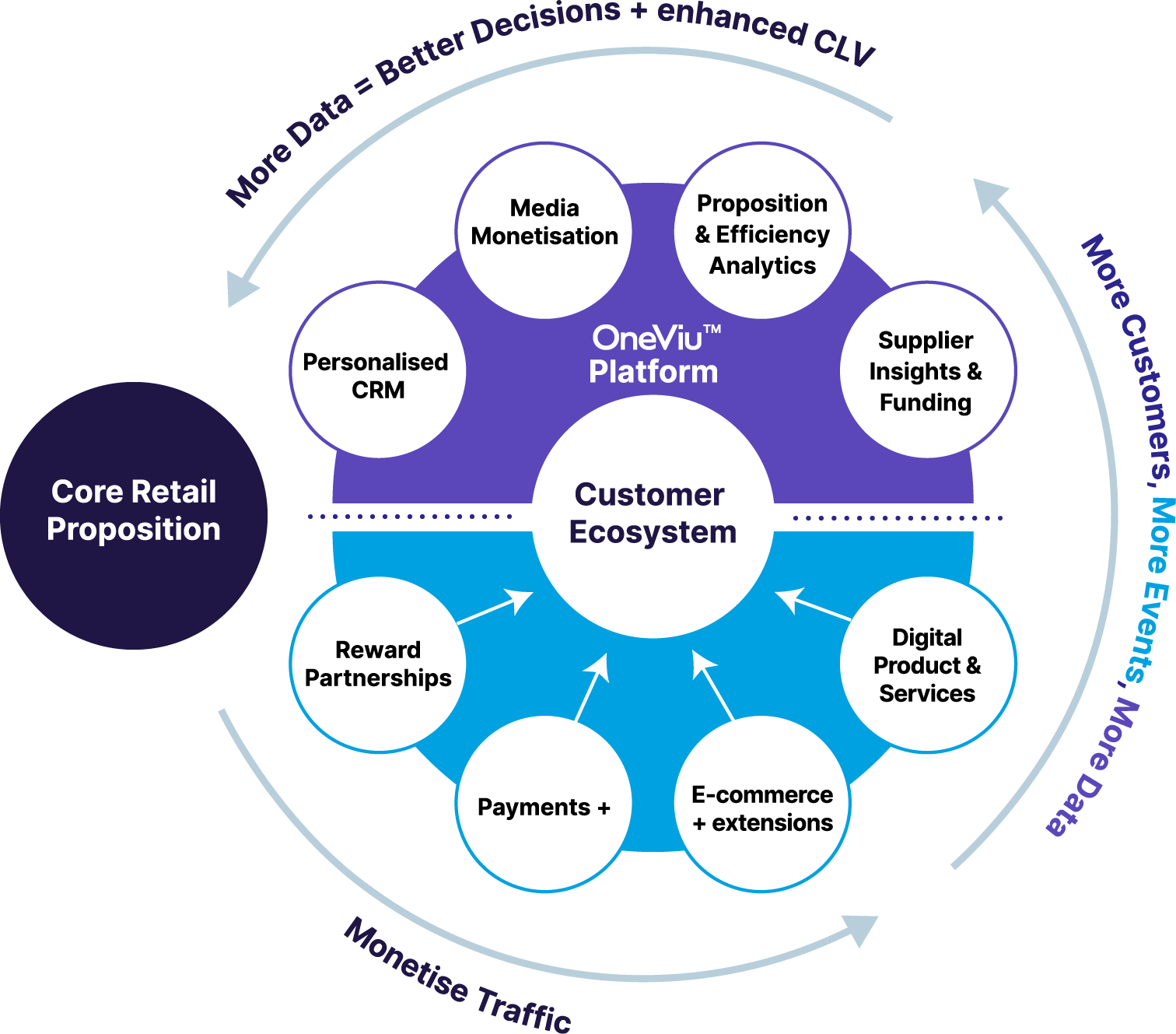

Development of a successful multi-partner programme can be complex but provided the right steps are taken, results can be achieved quickly. Exhibit 2 shows Tecsa’s approach to creating a successful multi-partner ecosystem.

Exhibit 2: Ecosystem Development

In our experience, the success of a multi-partner programme is dependent on several critical factors.

1. Coherent Value Proposition

Where larger programmes often miss the mark is that there isn’t a coherent thread that links the partners and rewards on offer to create a compelling value proposition that attracts and keeps customers willingly engaged in the programme.

Some multi-partner loyalty programmes can seem like a hodgepodge of partners and rewards, leaving customers confused regarding the actual value they offer. They have to frustratingly sift through the programme to find the parts that are relevant to them. Without a strong sense of connection to the programme, communication feels overwhelming and ultimately breeds annoyance and finally rejection.

On the other hand, with a more unified programme, the customer has a clear understanding of its core value. Communications are warmly received as the customer cares about the programme, which in turn fosters engagement and retention.

The difficulty is in how to foster this coherency. There are many components to this, but the most important factor is to make sure to partner with the most desirable companies in each vertical covered by the programme. At Tecsa, we approach this problem by following a meticulous selection process. We begin with a long cross-vertical list of potential partners and narrow it down by evaluating their customer propositions and potential contributions to the programme. We then initiate negotiations with the shortlisted partners.

2. Tangible rewards

Customers need to feel that they are getting value from the programme, and they will engage more with it because they feel that they can earn more.

There needs to be a versatile earn-and-burn mechanism that makes it easy for users to spend the points they have been accruing. Customer life-time value is typically signficantly higher for customers who redeem (‘burn’) than for those who don’t, so it’s important to remove barriers to redemption, without cannibalising existing spend.

For service extensions to work, a retailer needs to have a trusted relationship with consumers. The recent push towards member pricing by many UK grocers could risk eroding this trust.

3. Robust Commercial Model

Financial management of a multi-partner programme can be complex. Loyalty currencies are powerful, but can involve multi-year liabilities, so need accounting for expiry and breakage. Similarly, loyalty benefits come from multiple sources (base incentives, promo activity, redemptions, partnerships etc.) and tracking this efficiently ensures effective opportunity prioritisation.

4. Customer and data-centric culture

Multi-partner programmes are a highly efficient and powerful resource for collecting zero- and first-party data. This data is becoming increasingly valuable with the demise of third-party cookies. Customers’ are typically more willing to share data when there is a fair value exchange. As discussed above, multi-partner programmes offer significantly greater value to customers than solus programmes (sometimes 10x more). Successful multi-partner programmes generate a huge number of interactions across diverse categories, providing participants with a uniquely rich and comprehensive source of behavioural and transactional data.

Programmes needs to be able efficiently capture and utilise this data to continuously refine all aspects of their value proposition, including assortment, pricing, and promotional selection. Effective management of this volume of data in near real-time can be complex. Tecsa’ OneViu tool is designed to help retailers and brands become more customer centric and to make faster, more effective decisions using their customer data.

For a more exhaustive list of critical success factors for multi-partner programmes, please get in touch.

Conclusion

Bringing together a coalition of leading partners into a single loyalty programme offers a compelling value proposition to all stakeholders, especially shoppers. Successful examples in the market have demonstrated how this approach can deliver an enduring competitive advantage through more engaged customers. While the concept of multi-partner programmes may sound simple, the execution can be challenging. It requires careful selection of partners, rigorous planning, and navigating technology and data science obstacles to embed appropriate capability. Take a look at a case study of how Tecsa helped the yuu Rewards programme rapidly integrate over 2,500 stores and restaurants, reaching over 4 million members (more than 50% of the population of Hong Kong). (https://www.thetecsagroup.com/case-studies/yuu-super-app)